Teaching Kids Money Management While Traveling: Our Greenlight Family Experience

How we use Greenlight debit cards to teach our daughters money management while traveling full-time. Real experiences from a worldschooling family using Greenlight internationally.

When we decided to sell everything and travel full-time with our three daughters, managing money got complicated fast. Not just the obvious stuff like different currencies and exchange rates, but the everyday reality of three kids who wanted to buy things with their own money while bouncing between countries.

Greenlight solved problems we didn't even know we'd have. It's not just a kids' debit card - it's become essential for how we handle family finances on the road.

The Problem with Traditional Banking for Travel Families

Before Greenlight, our kids' money was a mess. Grandparents would send birthday cash that we'd have to convert, carry, and somehow keep track of whose was whose. Lily's souvenir money would get mixed up with Cora's allowance, and Harper's birthday cash from Grandma would disappear into our general travel fund.

The kids never really understood their money because it was always abstract - just numbers we'd tell them they had. They couldn't see it, couldn't access it, and definitely couldn't learn from it.

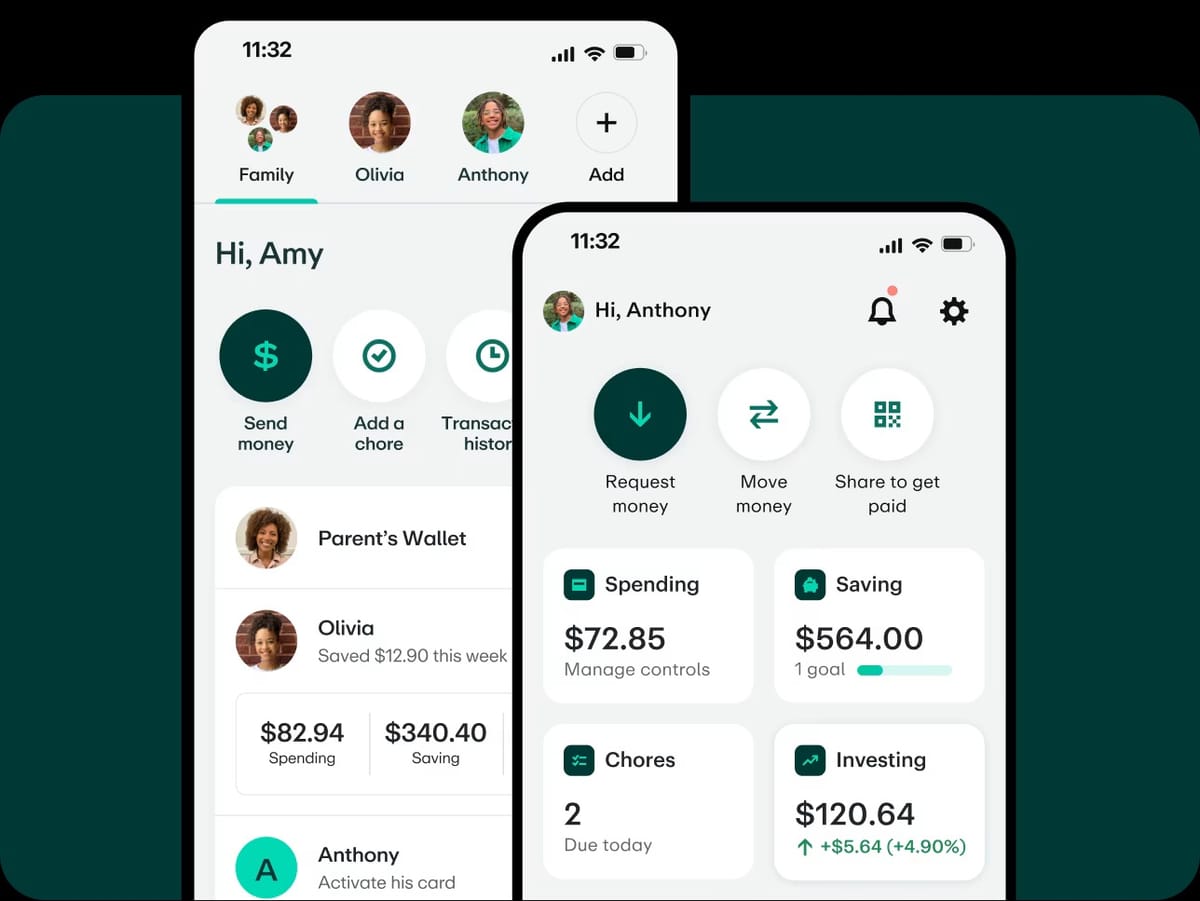

Here is a fun little teaser commercial we did for Greenlight 😄

Why We Actually Love Greenlight

The biggest game-changer? Their money stays completely separate from ours. When grandparents send birthday money, it goes directly to their Greenlight account. No more us playing bank and trying to remember who had what.

Each girl can see exactly how much money she has, where it came from, and where it goes. Real money, real decisions, real consequences.

It Works Everywhere We Go

The card works in every country we've visited. Japan, Thailand, Europe - doesn't matter. The kids can buy their own snacks, souvenirs, whatever, without us having to figure out currency exchanges or carry exact change.

In Bangkok, Cora wanted street food that cost 40 baht. She pulled out her Greenlight card, paid for it herself, and immediately saw the charge in the app. She started connecting that 40 baht was about $1.20 USD and began understanding real exchange rates.

Grandparents Love It Too

This might be our favorite unexpected benefit. Grandparents can instantly send money for birthdays, good grades, or just because. The kids get excited seeing money appear in their accounts, and grandparents love knowing their gift went directly to the grandkids.

No more birthday checks that take weeks to deposit or cash gifts that get lost in our travel chaos.

How We Actually Use It

Allowance Without the Hassle

Each kid gets weekly allowance deposited automatically. Lily gets $10, Cora gets $8, Harper gets $5. It happens every Sunday whether we're in Tokyo or Tenerife.

They can spend it however they want, but they can also see exactly where their money goes. Lily discovered she was spending $30 a month on snacks and decided to cut back to save for a camera.

Chores That Actually Pay

The app lets us pay for chores instantly. Harper puts away all her toys without being asked? $2 appears in her account immediately. Cora helps carry luggage at the airport? Another $3.

It's way better than promising to pay them later and then forgetting.

Real Spending Decisions

In Switzerland, everything is expensive. Harper wanted a stuffed animal that cost $25. She looked at her app, saw she had $18, and made the connection that she needed to wait or choose something cheaper.

No crying, no begging us for money. She understood the math and made her own decision.

The Problems It Solves

No More Cash Juggling: We don't carry three different kids' cash in three different currencies. They have their own cards and handle their own money.

Instant Transfers: Need to send lunch money when the kids are at a museum program? Done in 30 seconds.

Spending Limits: Cora can buy snacks at the convenience store but can't accidentally spend her entire savings on arcade games.

Emergency Access: If we get separated (happens in crowded markets), each kid has access to money for transportation or emergencies.

What the Kids Actually Think

Lily (10): "I like seeing exactly how much money I have and not having to ask you guys all the time."

Cora (8): "When Grandma sends me birthday money, I can see it right away instead of waiting forever."

Harper (6): "I can buy my own snacks and I don't need help counting money."

The Learning Happens Naturally

We're not sitting the kids down for financial literacy lectures. They're learning by using real money in real situations.

Lily started comparing prices between countries automatically. Cora asks questions about why things cost different amounts in different places. Harper understands that she needs to earn money before she can spend it.

The app shows spending categories, so they can see patterns. Lily realized she was spending more on food than toys and decided to pack more snacks from our Airbnb.

Beyond Just a Debit Card

Greenlight offers investing for older kids, but honestly, we're still figuring that out. For now, the basic money management and spending control features are exactly what we need.

The customer service has been great the few times we've needed help. Once Cora's card got demagnetized in Thailand, and they sent a replacement to our next destination.

Getting Started

Setting up accounts for all three girls took about 20 minutes. We started with small amounts to test everything, then gradually increased as the kids got comfortable.

The monthly fee ($5.99 for our plan) easily pays for itself in convenience and the education value. Plus, no more losing cash or trying to track who spent what where.

If you're traveling with kids and tired of managing their money manually, Greenlight is worth trying. It turned money management from a constant headache into something that actually works.

Frequently Asked Questions

Does Greenlight work internationally?

Yes, we've used the cards in over 20 countries without issues. There are foreign transaction fees (which we factor into our travel budget), but the convenience outweighs the cost.

What happens if a card gets lost or stolen?

You can instantly freeze the card from the app. Since our girls are so young we always leave their cards frozen and just un-freeze them for purchases. We've had enough problems with stolen cards of our own, we'd rather not teach them that lesson yet.

How much does Greenlight cost?

Plans start at $5.99 per month for the basic plan, which covers up to five kids. We use the Greenlight Max plan ($9.98/month) which includes investing features for our older daughters.

Can grandparents send money directly?

Yes, this is one of our favorite features. Grandparents can transfer money instantly to each child's account. The kids get notifications when money arrives, making it feel like a real gift.

What's the minimum age for Greenlight?

There's no minimum age requirement. Harper started using her card at age 5 with supervision. The app interface is simple enough that even young kids can understand their balances and recent transactions.

Can parents control spending completely?

Yes, you can set spending limits by category, block certain types of purchases, and require approval for transactions over a certain amount. We have Harper's card set to require approval for anything over $10.

How do kids earn money with Greenlight?

Parents can set up chore lists with payment amounts. When kids complete chores and parents approve them, money is automatically added to their accounts. You can also send instant payments for extra chores or good behavior.

What if we're in a country that doesn't accept Mastercard?

This has only been an issue in a few very remote locations. In those cases, we fall back to cash for the kids, but this happens rarely since Mastercard is widely accepted globally.

This post contains affiliate links. When you sign up for Greenlight using our link, we may earn a commission at no extra cost to you. We only recommend services our family actually uses and loves.